In order to become a mortgage loan officer, you should be about 18 years old and you will hold a good highschool diploma. Without expected, a college education when you look at the a monetary or company career is recommended because rounds your studies and you will makes you shine in order to future employers.

- register through the All over the country Multistate Certification Program (NMLS);

- submit to criminal and you may borrowing from the bank criminal record checks;

- bring no less than 20 times out of pre-certification education; and you can

- pass the brand new national Safer MLO examination.

Effective interaction is paramount for mortgage officials. They have to be capable obviously articulate and you may make clear cutting-edge monetary principles to help you readers. They need to have good monetary acumen. Knowledge rates, fico scores, debt-to-income rates, and other financial subjects is a large part of the reputation.

Problem-solving experience are also expected. Mortgage loan officers must be able to believe critically and you will solve problems that can get arise within the mortgage techniques. An experienced financing manager will be able to select a challenge, create choice choices, surmount obstacles, and gives recommendations.

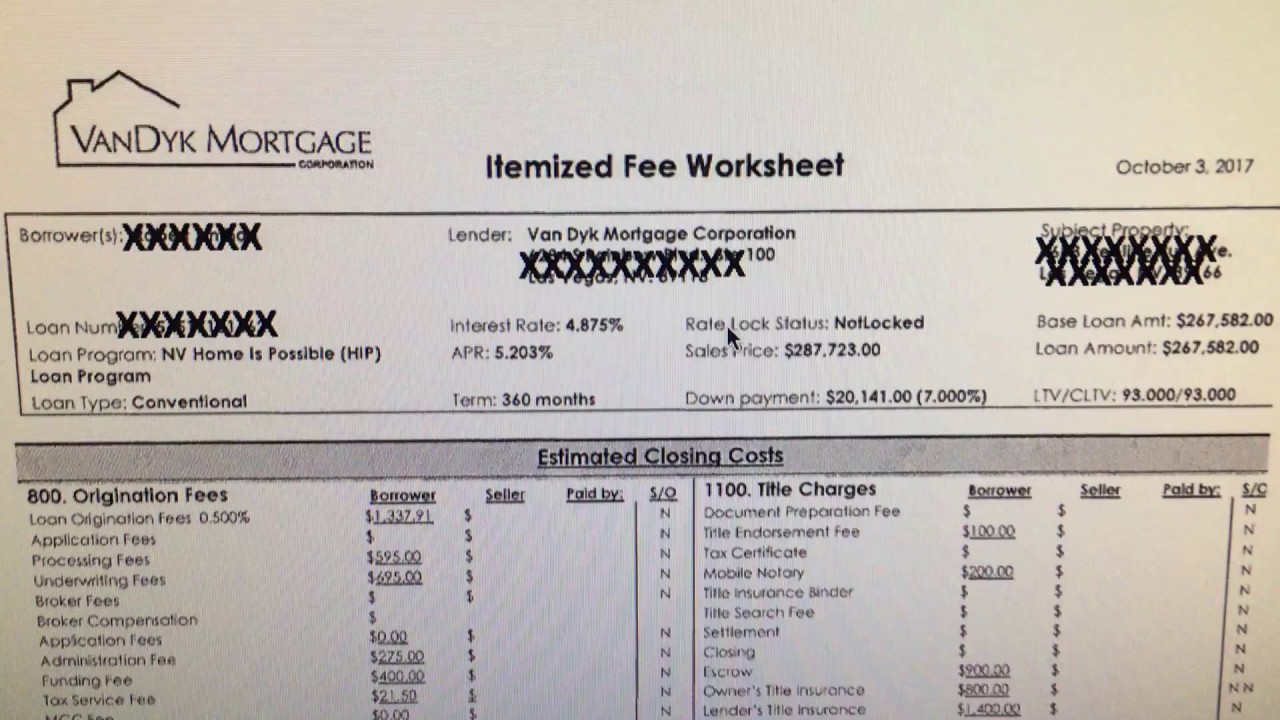

Awareness of outline is even very important. This careful method to the things they’re doing is needed considering the absolute number of paperwork and you will legal records needed in getting good home loan. Having the ability to prevent mistakes or at least quickly choose and you can correct them can assist the method move forward more smoothly.

Conversion process function is certainly one skill that lots of people do not consider for mortgage loan officers. They not only originate funds, and also sector financing products. They should be adept on pinpointing leads and persuasive enough to compel possible individuals to use.

Mediocre Paycheck and you may Occupations Frame of mind

If you find yourself income can vary according to state and boss, the entire job outlook to own mortgage loan officers is actually positive. According to the Agency regarding Work Statistics, the average paycheck by loans in Parrish 2021 is actually $63,380 a year. Remember that mortgage officials also generally discover certain form of payment based on the number of the borrowed funds.

Evaluating Home mortgage Chip vs. Mortgage Officer: Similarities & Variations

Each other home loan processors and you will real estate loan officials gamble crucial roles when you look at the assisting the borrowed funds mortgage processes. Let’s simply take an instant go through the differences in place of work, compensation, and you will a better job, less than.

Work environment and you may Agenda

Mortgage processors generally operate in office environment. They are usually used by financial institutions, borrowing unions, home loan businesses, or other lending establishments. It works closely which have underwriters, loan officials, or other interior team members. Overall, it works typical workplace occasions (Monday-Friday) for 40 occasions a week. However, they may performs overtime during peak attacks.

Mortgage officers possess certain offices. Certain work with banking institutions or any other lending institutions and will wade towards an actual work environment every single day. Other people functions remotely off their homes. Possibly, they’ve group meetings with readers, real estate agents, or any other industry advantages beyond your place of work. The schedules including differ, because they generally have significantly more freedom than simply mortgage loan processors. As they are customer-against, they have a tendency to be hired to the clients’ schedules. This means they may works afterwards about nights, otherwise into vacations.

Payment and you can A better job

Mortgage loan officials normally secure fee-oriented settlement and additionally a bottom income. One percentage depends from the amount borrowed and will differ according to company’s framework. More funds you to a mortgage manager closes, more capable earn.

Home mortgage processors, although not, are repaid a fixed paycheck otherwise hourly rate and you will do maybe not secure profits centered on financing volumepensation to possess loan processors is actually fundamentally a great deal more steady, regardless if usually not as high since the that loan officer’s.