cuatro. Part-day performs: While trying to find extra money but do not must utilize your own Tsp discounts, envision trying out an associate-day occupations otherwise freelance work. This will provide you with the cash you need to safety your own expenses when you are making it possible for your own Tsp membership to keep increasing uninterrupted.

By considering these alternatives in order to Tsp very early distributions, you can make a far more informed decision on precisely how to handle your finances and you can advancing years deals. While it is generally appealing to get into your bank account very early, taking the time to explore other options pays off into the the long run.

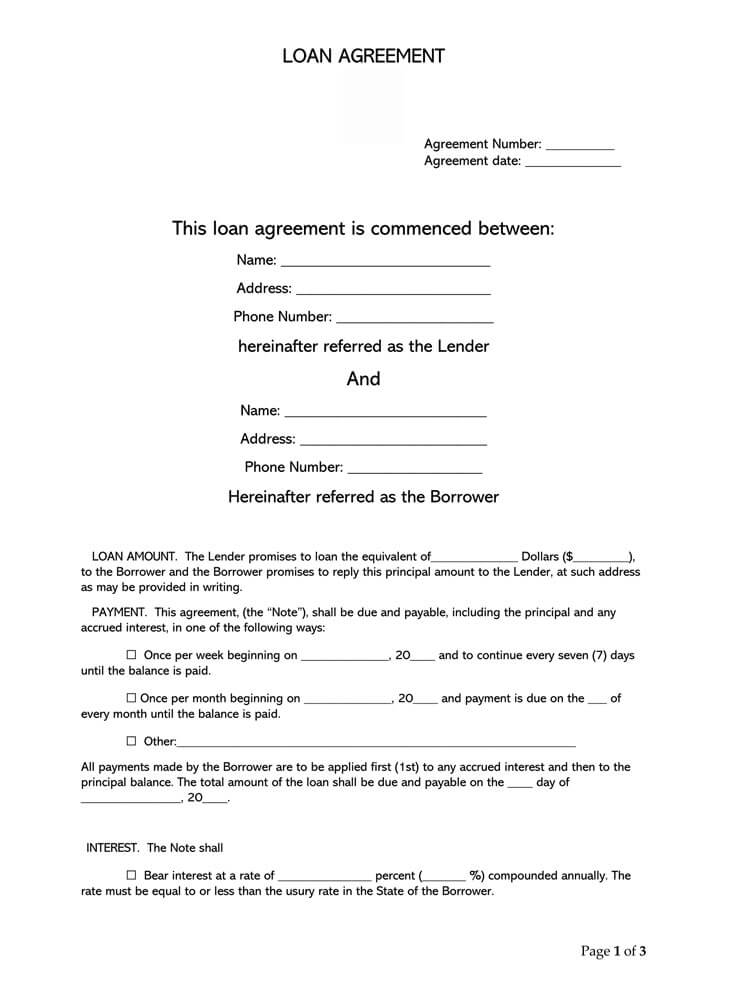

With regards to taking right out that loan, you will find several possibilities to prospects, along with a great Thrift Discounts Bundle (TSP) mortgage. A tsp loan is a kind of financing which enables government group to borrow cash from their Tsp account. These types of loan are good for people who you need immediate access so you can bucks, but it’s crucial that you think both the pros and cons just before making the decision.

One of the many advantages of taking out fully a tsp loan is that the rates are below other styles away from fund. The speed to possess a tsp mortgage is dependent on the fresh new most recent Grams Money rates, that’s normally less than the newest costs supplied by commercial loan providers. Likewise, the attention repaid on a tsp loan is paid down into the fresh borrower’s membership, and so the borrower is essentially investing on their own right back having focus.

Another advantage of taking out a TSP loan is that there are no credit checks required. This can be beneficial for individuals who may have a poor credit score or no credit history. Additionally, TSP financing not one of them guarantee, which means that borrowers do not need to put up any assets as security for the loan.

Flexible repayment terms and conditions: Teaspoon financing render flexible repayment terms and conditions, and thus borrowers can choose just how

But not, it is vital to remember that you can find disadvantages to taking aside a teaspoon mortgage. For example, if for example the borrower is not able to repay the borrowed funds, the fresh new the balance was handled just like https://paydayloanalabama.com/bear-creek the a shipping and you can subject so you’re able to income tax. On top of that, in case the borrower try underneath the chronilogical age of 59 step 1/dos, they could additionally be subject to an effective ten% very early detachment penalty.

step one. straight down rates of interest: As stated prior to, Tsp financing generally have all the way down rates of interest than many other kind of fund. This is certainly good for people that are trying help save cash on interest charges.

2. Zero credit monitors: Teaspoon finance not one of them borrowing checks, and thus people with poor credit ratings can still meet the requirements for a loan.

step three. No collateral needed: Tsp money do not require guarantee, meaning that individuals do not need to create any possessions because safeguards into mortgage.

Full, taking right out a tsp loan might be recommended getting federal employees who are in need of quick access in order to dollars. not, you will need to cautiously think about the pros and cons before making a choice.

4.Downsides out-of Providing a tsp Mortgage [Original Web log]

Regarding the new Thrift Discounts Plan (TSP), it could be tempting to think of it a resource away from disaster money. While delivering financing from the Tsp membership seems like a magic bullet, you will need to weighing the consequences before carefully deciding. Let us explore a number of the downsides off bringing a teaspoon financing:

step one. Restricted gains prospective: When taking a teaspoon financing, you happen to be essentially credit money from your future care about. The money you use has stopped being committed to the marketplace, you lose out on prospective growth. Even worse, should your market work well during the time you have the loan, it is possible to miss out on those people increases.