six. How often should i spend my amortization? You have made the choice of how often you pay your own amortization. Generally speaking, it’s month-to-month or twice 30 days. Should you want to day it along with your payroll schedules, month-to-month otherwise double 1 month sounds a beneficial. But if you don’t have a routine month-to-month income, every quarter could make a lot more sense. If you’d like to automate your payments, fortnightly is the better.

You can test in order to negotiate into financial and have to help you payday loans Argo waive otherwise lower several of them

Fortnightly, otherwise all of the 14 days, is not necessarily the identical to twice thirty days. On second, you end up investing 24 moments annually. Not too with fortnightly, for which you spend twenty-six times per year. Therefore you’re particularly expenses an extra times inside the a year. You end up spending your loan reduced, shaving regarding regarding 24 months getting good 20-12 months mortgage.

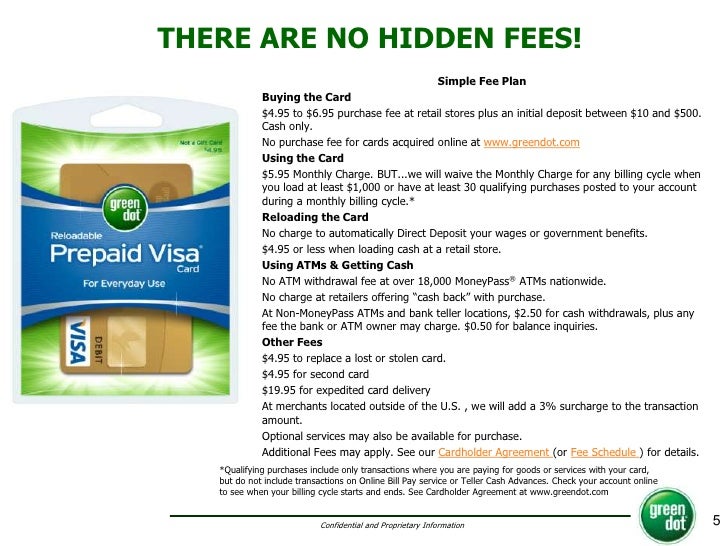

7. What exactly are your own other costs? Will overlooked, other mortgage-related charges soon add up to finances aside. Require a listing of most of the charges. If you find yourself to get a home from one of one’s bank’s accredited creator, the assessment fee was waived. Finance companies charge a non-refundable software percentage just to procedure the job, a handling commission so you’re able to techniques your own accepted financing, an appraisal payment to help you imagine the market worth of your home, and you will a beneficial notarial commission for legal counsel. Therefore if the lending company currently place the new appraised value equal to the newest price of the house, it should not charge a fee an appraisal commission.

The government together with requires an article of the experience. You need to pay your neighborhood regulators to own registering your mortgage. And every season, you have to pay city hall assets income tax. You have to pay documentary seal of approval taxation to possess records such as your home financial. However if you will be purchasing the property directly from a supplier, you have to pay transfer income tax in it.

These are the a lot more costs you have to pay the financial institution upfront when you get a loan and possess approved, named settlement fees

Discover premiums you only pay new bank’s licensed insurance people each year, for example homeowners insurance to cover against flames, disturbance, typhoon, or another enjoy. Constantly, it’s simply flame insurance. There’s also financial redemption insurance (MRI), which is life insurance coverage that may pay off the loan harmony if you pass away till the end of your own label. Ask whenever you can get own insurance rates rather than coursing they from the lender, hence brings in a percentage with the advanced. 8. What the results are basically try not to pay in the long run or if I shell out in advance? You earn recharged both a punishment and you can notice for individuals who fail to expend your amortization on time. There are lots of finance companies which might be a lot more easy and certainly will let you off of the hook if you are later several times. Should you get slapped a fee but you have been if you don’t a great borrower, inquire to have it waived.

Now, inside the time of your loan, you can intend to make changes to the home loan. Inquire the lending company exactly what are the guidelines and you will costs for individuals who want to pre-spend, pre-terminate, or refinance. For individuals who pay back area of the financing through to the stop of your own term to save towards the attract, the bank might slap a good pre-percentage fee, especially if you take action on day besides the brand new repricing day. For those who pay back region the entire mortgage till the prevent of one’s term, their lender often costs an excellent pre-cancellation fee. While you opt to import the mortgage to a different lender, you’ll have to pay a beneficial refinancing commission.