Of many individuals overlook dollars-away do it yourself fund since their first mortgage, but often it is reasonable economically. Yet not, you should consider an earnings-aside re-finance to fund your residence home improvements when you yourself have, state, an 8% mortgage as you might possibly rating a great six.5% or more speed when you look at the .

4. Individual Do-it-yourself Mortgage

A different popular loan solution, or even should touching the guarantee, try your own do-it-yourself loan. It is an enthusiastic unsecured personal loan giving bucks to have family improve. The loan size and you will rates are determined by the personal borrowing from the bank get. Thus, you will have a good credit score to find the best rates. For the 2024, you may get a personal loan with an excellent 6-8% rates when you have superb borrowing. A benefit of personal loans is, for those who have a good credit score score, the mortgage is approved rapidly. You can acquire cash contained in this 24 otherwise 72 circumstances, just after approved. For those who have advanced level credit, you might also be eligible for the newest zero notice do-it-yourself financing.

Specific unsecured unsecured loans are specially titled home improvement financing. Such personal loan rates start around 7% and 36% in 2024, which means your interest relies on yours credit. Extremely online personal bank loan lenders are adverts cost in the ten% to help you 20% variety to have credit scores between 700 to help you 800 fico scores.

5. 203K Financing

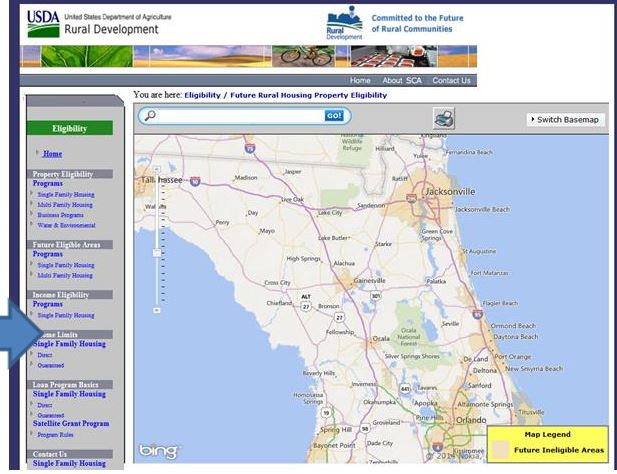

There are a number away from regulators money that can easily be made use of getting renovations. Among them ‘s the 203k FHA financing, which is supported by the us government. The new 203K programs offers low interest investment getting home improvements, structure and you will treatment. It FHA do-it-yourself financing is out there of the FHA-recognized lenders with support regarding the United states bodies. Its not necessary advanced borrowing from the bank discover good 203k mortgage and you may competitive financial costs appear. This choice needs an enthusiastic FHA mortgage and you can qualify for doing $thirty five,000 in home improvements.

Yet another government financing to take on is the Identity We Assets Improvement Financing System. This is certainly a loan out of a private lender which is supported by FHA. These do-it-yourself loans are made to be taken for your update otherwise repair to help make the home far more livable. Although not, the bucks cannot be utilized for a luxury items instance a swimming pool otherwise hot spa. The eye cost is actually reasonable since they are backed by the fresh You regulators.

6. Bank card

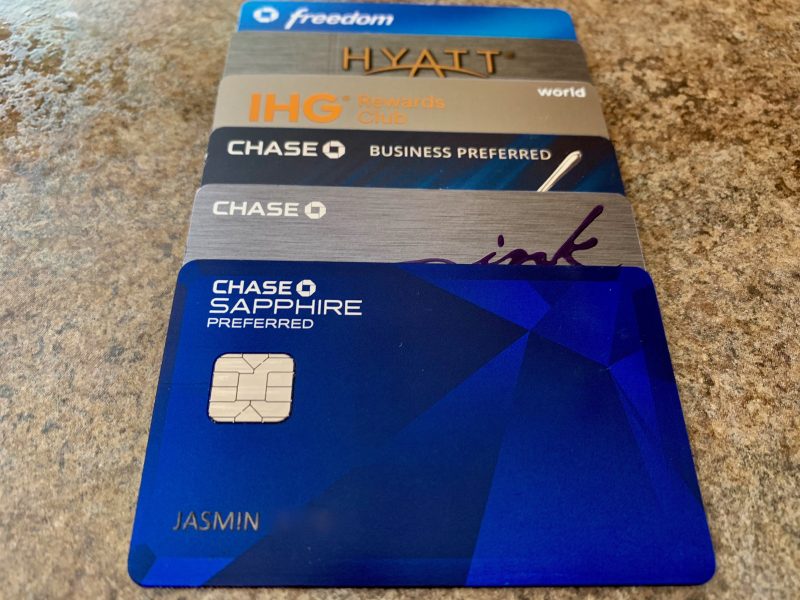

Handmade cards normally have high prices and you can commonly good for high priced family home improvements. However, you’ll find instances when playing with credit cards tends to make experience. If you have a good credit score, you could qualify for a zero-focus bank card who’s zero notice for at least an effective year. This really is an effective investment alternatives for people who spend the money for financing off before the rate expands.

seven. Cash is Queen

As much as possible be able to make home improvements as opposed to including obligations and borrowing from the bank dangers you can even save yourself particular soreness. Extremely people lack adequate money saved to afford do-it-yourself ideas they require completed. Thinking ahead to invest in your property enterprise is vital to avoid more can cost you and you can coming monetary items. If at all possible, rescuing up for a particular opportunity and utilizing that money is how to purchase a home update. But not, if this is not you’ll, the fresh RefiGuide makes it possible to come across multiple loan providers in order to apply at fund home improvements and much more.

Regardless if you are looking to create a luxurious pool and health spa, re also home otherwise your home is due for most upgrading and updating, you will need to be sure you have the proper savings in order to deal payday loans Maine with your panels.