Purchasing a property should be absolutely exciting. It is natural so you’re able to lean into a mortgage to invest in your home. But not, it is strongly suggested to find the best financial readily available therefore that you could get the best experience. While deciding the speed given, the capital expected, processing commission, or any other costs, there are other factors that you ought to envision. Here are some tips that can be used to have the greatest financial experience.

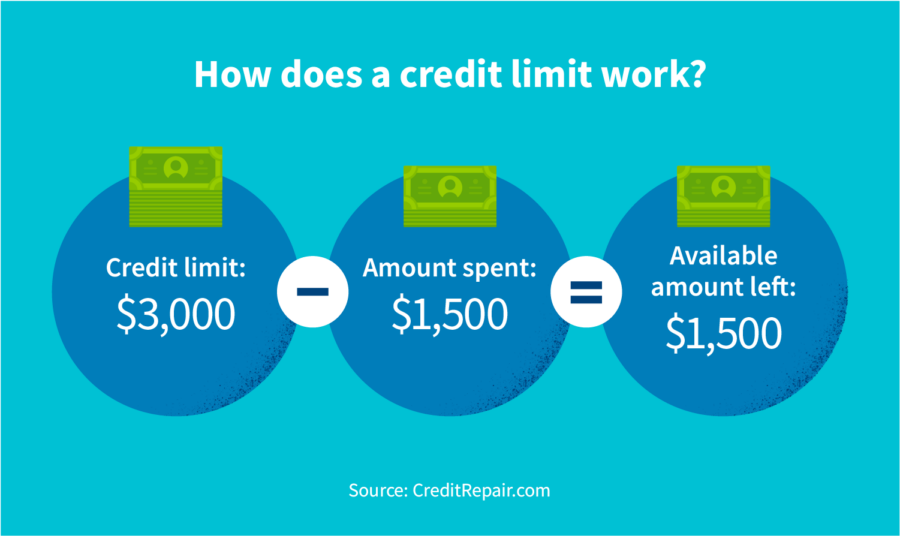

1. Look at your Credit score:

One of the most key factors that a financial otherwise lender have a tendency to ensure is your credit history. From the examining so it rating, they may be able evaluate your own creditworthiness. Experts recommend getting a credit score off 750 or more than. With a top credit history can also fetch you other gurus instance a minimal interest. If you prefer to evolve your credit score, you can do therefore by being timely together with your credit costs payments, paying off a massive personal debt, etc.

Dependent on the lender otherwise lending institution, the variety of down payment can vary. Always, they range anywhere between dos.25% and you will 20% of your own price of our home you plan to order. Whenever you are designing a monthly finances, ensure that you store the necessary currency to suit your advance payment.

step three. Keep Economic Records In place:

Inside the financial app techniques, you are needed to fill in a summary of files. Make sure that you possess this type of data able and also in castle to speed up the program procedure. Be sure that you have got all the necessary files such ID facts, target proof, financial comments, payslips, tax efficiency, form-16, while some.

4pare Also offers:

Before choosing a home loan, make sure that you compare brand new available now offers. A few banks can offer decreased interest rates with other benefitspare such offers and select home financing that fits the needs an educated.

5. Fool around with a mortgage Calculator:

While making sure that the prerequisites to possess home financing application processes is prepared, very is planning your fees. Using a mortgage calculator is recognized as being one of the best family money information because it helps you bundle the finances during the a document-inspired styles.

six. Know Information regarding The Rates of interest:

The pace which is given for your house financing performs an important role inside the determining the cost of your home mortgage. Seek advice from your financial regarding the rate of interest, should it be a fixed or a drifting interest rate americash loans Foley. This can help you stay waiting and you will guess your repayments.

eight. Get Pre-Qualified:

Insurance firms your property loan pre-licensed, you could potentially automate the complete application procedure and also the verification process. So you’re able to pre-meet the requirements, you have to submit debt advice such as your income, offers, and you can assets together with your property files.

8. Earnestly Address The Lender:

When you’re contacted by your lender from more criteria otherwise needs, make certain you function easily. This can help the financial institution keep application for the loan productive and you will progress on the procedure quickly.

9. Discover Some other Financing Choices:

There are lots of available options with regards to to find mortgage brokers. As an instance, you might often favor a fixed rate of interest or a floating interest. Make sure to check with your lender throughout the most of the offered solutions.

10. Keep Credit Models On the Techniques:

In the middle of the house financing confirmation process, lenders can get look at your credit history. So, it is advisable to keep a beneficial monetary activities although your mortgage is canned.

In a nutshell

When you’re opting for home financing, it is critical to learn all of their related factors. Likewise, be sure that you package your own fees plan beforehand thus that you could economically prepare yourself. If you are searching to try to get a home loan, you could submit an application for one having Piramal Resource Houses and Financing and you may sense several benefits and additionally quick loan sanctions.