Many of our customers are concerned with financial affordability, with mediocre household pricing in the united kingdom at around ?280,000 and better throughout the the southern part of.

How to work out the income having ?three hundred,000 financial revenue:

Play with the mortgage affordability calculator below for information on how much you can obtain, exactly what the prices are and you may which deals you’re eligible to have.

Potential customers typically provides a switch shape within their heads. This is often because they have observed the home or even the area’s home rates.

All of the mortgage lenders has different credit requirements, we are going to be sure to fulfill the pro loan providers qualifications. Rating a good ?300,000 mortgage price less than:

What’s the minimum earnings necessary to get a beneficial ?three hundred,000 home loan?

Certain loan providers only take your normal PAYE salary into account, while some will factor in incentives and you may profits. Self-employed consumers will need why not look here to show the money having fun with levels or HMRC tax returns.

Lenders will would a cost evaluation that looks at one another your income and you may outgoings. As a result for those who have extreme costs or dependents, it may impression exactly how much you can acquire.

Lenders have a tendency to usually determine how much you can use of the multiplying your income because of the four-and-a-50 % of otherwise five times. Specific loan providers can give more which.

How much put is needed to rating a beneficial ?3 hundred,000 real estate loan?

How big is the deposit try an option cause for choosing extent you might acquire and how far your own financial tend to finish costing.

Increased deposit increases your odds of getting a beneficial ?300,000 mortgage. This will will let you access the quintessential aggressive mortgage cost in the business.

You might nonetheless rating a home loan with good 5% otherwise 10% put, but this might be at increased interest rate.

What’s the lowest deposit required to rating an effective ?300,000 home loan?

Mortgage brokers commonly set a maximum mortgage-to-well worth (LTV) for each and every mortgage product. This is one way most of the latest property’s well worth you can use because the a home loan. The remaining number will be the put.

Instance, home financing having a max LTV regarding 90% will need good 10% put, if you find yourself a home loan that have a maximum LTV regarding 70% requires a thirty% deposit.

You will also have significantly more equity in your home so it’s a beneficial good idea to get off a more impressive put if you possibly could.

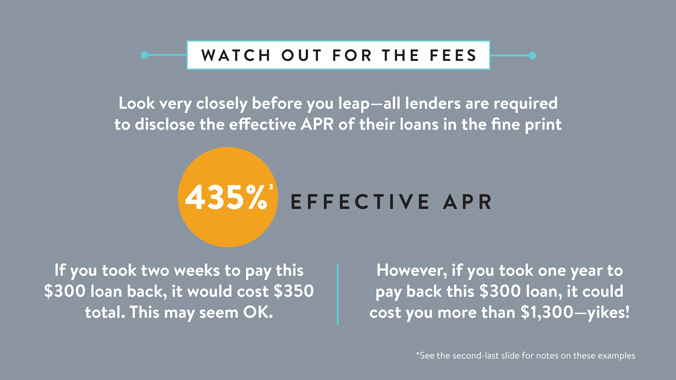

Rate of interest

For those who have a variable rate financial, the interest rate can get changes in term. This will suggest your payments will go up. If you have a fixed rate financial, the speed and your monthly payments will remain an equivalent during the course of the fixed speed that’s generally speaking several otherwise 5 years.

Home loan Term

Your own monthly obligations would be influenced by the duration of the home loan label. New lengthened the borrowed funds identity, the lower their monthly installments might possibly be. But you will shell out way more attention total.

Cost versus attention-only

Your monthly payments might be straight down for individuals who choose an enthusiastic interest-simply financial. You only pay the interest each month towards the a destination-only financial, and never the administrative centre, which means that your money would be reduced. But not, at the end of the phrase you can easily still owe the amount of cash you in the first place lent.

A cost (resource and you will appeal) financial ensures that you will have to pay-off both the money and the interest each month. Therefore, their monthly installments will be more. However, at the conclusion of the phrase possible individual the house outright.

The thing that makes affordability very important?

A lender have a tendency to want to know simply how much you get whenever determining the mortgage application. This might be indicative of your capability to spend their monthly payments.

Of many loan providers usually lend you between 4 and you can 4.5x their annual income. For individuals who apply for a combined home loan, you will need to features a blended income of at least ?66,667 to help you ?75,000 to track down good ?3 hundred,000 home loan.

Loan providers will look at the ability to spend their debts. That it matter is calculated by the exercise their month-to-month outgoings because a percentage of monthly income. Its shown within the rates. Match affordability is actually lower than thirty-six%.

For many who secure ?six,500 four weeks, either as you otherwise individually, and you will spend ?dos,100 in your expenses, your own affordability is thirty two.3%. Loan providers could possibly get stress-test your ability to pay for the mortgage repayments before you make an excellent final decision.

Am i able to rating a ?300,000 home loan if you have borrowing troubles?

When you yourself have had borrowing from the bank issues in earlier times, otherwise have a woeful credit get, its more complicated to acquire a mortgage that will feel energized a top interest rate.

You will find info in our Less than perfect credit Mortgages area. It’s also possible to e mail us free-of-charge financial pointers to talk about your credit score.

May i score good ?3 hundred,000 financing having senior years?

Certain lenders place a limit towards the restriction age a debtor would be at the end of the borrowed funds identity.

To decide how much cash they might become ready to lend, very lenders will look during the count the house will generate when you look at the local rental earnings. Nevertheless they might expect you to definitely has actually a personal earnings with a minimum of ?twenty five,000.